Unemployment Claims Management

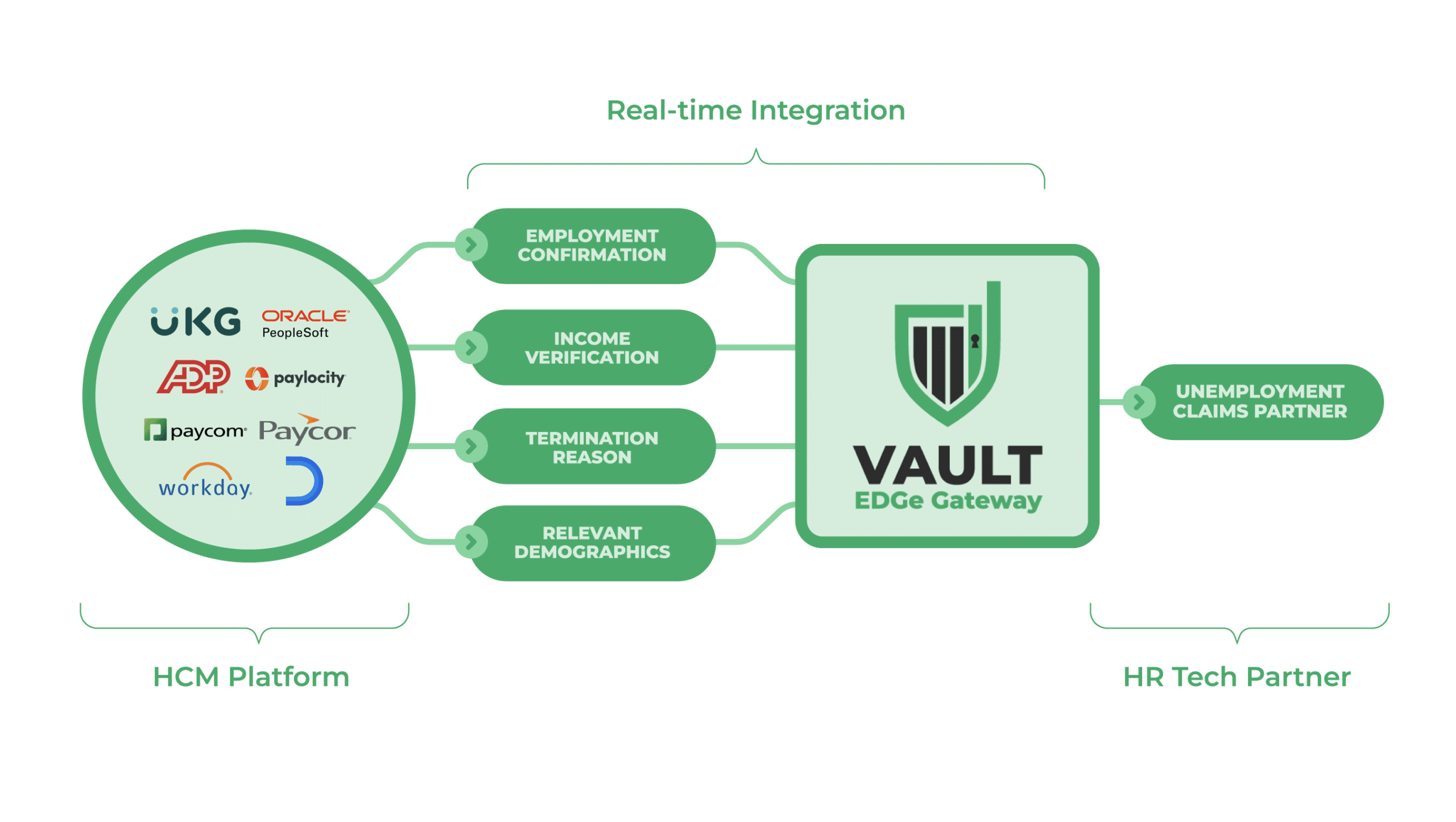

Vault Verify powers the most efficient, effective, and secure unemployment claims management programs available. The Vault EDGe Gateway‘s real-time APIs provide timely and accurate data to help employers eliminate unnecessary labor burdens while reducing corporate unemployment liabilities – all without losing control of your sensitive employee data.

Why Choose A Vault Verify Partner for UCM?

Vault Verify provides an exclusive, industry-leading data solution to streamline and protect the sensitive employee data used for your unemployment claims management process.

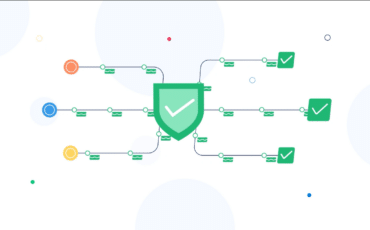

The Vault EDGe Gateway is a secure real-time API that Vault Verify establishes with your HCM platform. This employee data gateway is a proprietary solution that empowers sanctioned HR tech service providers, including selected UCM service providers, to access key data and receive event-triggered alerts.

With this enhanced capability, the HR labor burden to support unemployment claims processing is reduced, while your data remains secure. Only the data elements needed for the claims processing are accessed in real time, reducing exposure risk and increasing accuracy and timeliness.

One integration, the Vault EDGe Gateway, can serve the needs of many qualified service providers within your ideal HR tech stack.

PLUS…Let Us Show You How to Save on Your UCM Service Cost!

Schedule a Demo

In just 30 minutes, we’ll show how our Vault EDGe Gateway empowers our Tax Credits partners to find your company substantial tax savings while saving you time and money!